The past year has made us all realize the importance of having a health insurance plan that covers all our needs when it comes to healthcare. It can be tricky trying to find a comprehensive plan that fits within your budget especially when you factor in the increasing premiums. The first step would be to understand the reasons behind the increase in premiums.

Health insurance premium primarily goes up because of two reasons:

- Age: Increasing age of a person is associated with increased health risks. So the premium you would pay at the age of 35 would be higher than what you would have paid if you got your health insurance at the age of 28. Therefore, one sure-shot way of reducing your premiums is by starting early.

- Increasing healthcare costs: Medical inflation is usually caused because of the technological advancements in healthcare, increasing costs of medical equipment, doctors & medicines. This in turn causes the cost of treatment to increase which in turn makes insurance expensive.

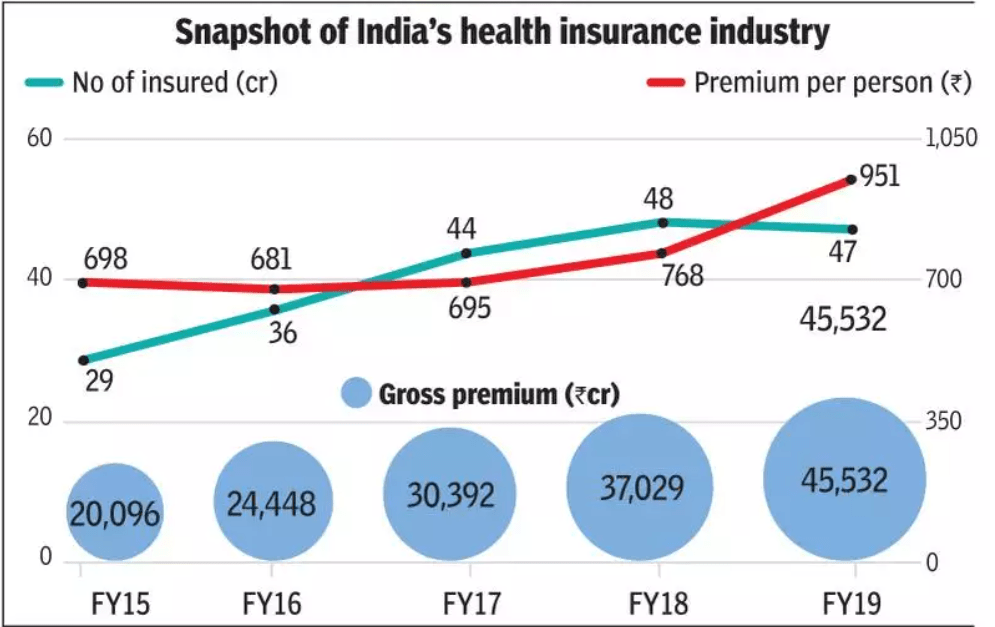

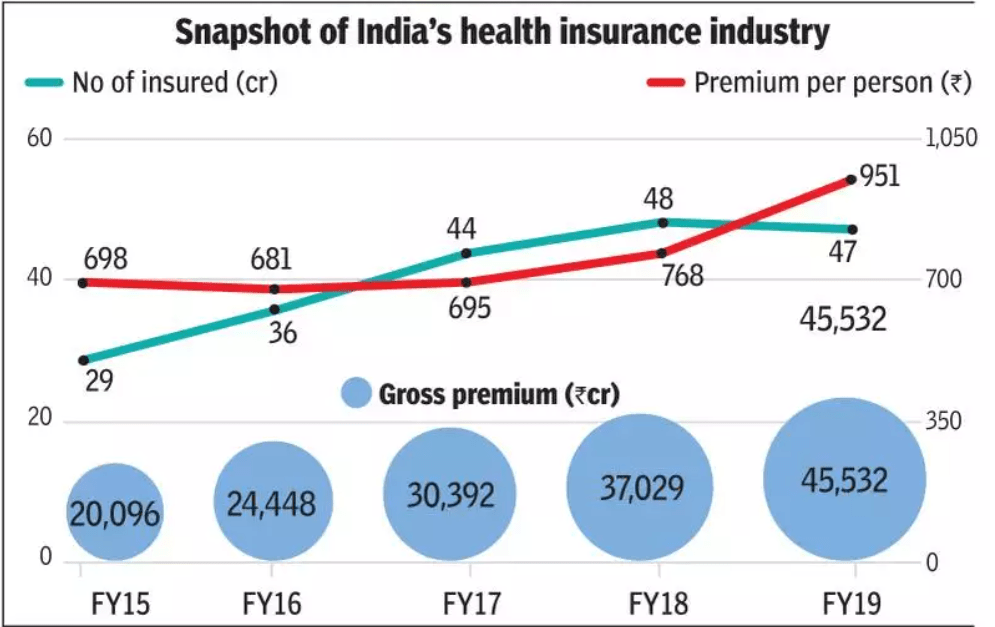

Another reason that led to the increase in the health insurance premium last year was the regulator’s efforts to make health insurance more comprehensive so that the out-of-pocket expenses for the insured are reduced. Health Insurance policies will now include mental illness and modern treatment methods such as oral chemotherapy, balloon sinuplasty, deep brain stimulation, among others. Below is a snapshot of the rise in premiums through the years.

Source: https://timesofindia.indiatimes.com/business/india-business/rising-premiums-may-hit-health-insurance-growth/articleshow/79554466.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

So what can you do today to get the best-possible policy? In this area being proactive will be a good bet. If you don’t have a policy yet, start researching and get your personal health insurance policy in place as generally, the rise in premiums has a lesser effect on renewals as compared to new policies. If you have a policy in place, evaluate your policy and the coverage it offers to ensure that all your healthcare needs are being met. You can also think about getting a top-up or a super top-up for your current plan to increase your cover.

To learn more about how the increasing premiums can affect your policies, get in touch with the OneAssure team for a personalized consultation.

OneAssure is a distribution platform that helps you make the right decisions on matters where health and finances converge. Visit oneassure.in to know more about your health insurance choices.

Read more about Different types of health insurance plans in India